SIPP or SSAS

Here we look at a comparison of self invested personal pensions (SIPPs) and small self administered schemes (SSASs).

Since the mid-1970s and the early 1990s respectively, small self administered schemes or SSASs, and self invested personal pensions or SIPPs, have been valuable tools in the financial adviser's toolbox for entrepreneurial and sophisticated clients.

Demand for these products continues to grow for clients wishing to strategise their retirement savings plans and who desire more flexible solutions to those offered through platform based offerings.

It may therefore be useful to set out some of the key differences between SIPPs and SSASs, the respective roles of the product providers and how advisers might select partners/providers for their client's needs.

What are the key differences of SIPP and SSAS?

Both are registered pension schemes and, with a few exceptions such as the defined benefit SSAS, are subject to exactly the same contribution rules for both individuals and companies. They are also subject to the same investment rules, except for one main exception, so are able to offer very similar investment solutions including commercial property. The main exception is that SSASs can make loans to the employer that participate in the SSAS but are subject to satisfying very strict criteria. SIPPs can lend only to unconnected parties.

Both SIPPs and SSASs should be able to offer the same flexibility when it comes to retirement and death benefit options including all those introduced by the 2015 "pension freedoms".

What are the other main differences of SIPP and SSAS?

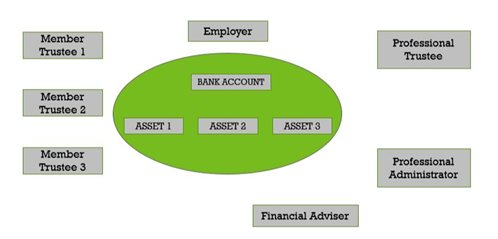

The best place is to start is with the scheme structure, the diagram below represents a trust based SIPP structure where the member is also a joint trustee:

A self invested personal pension is a product of the SIPP provider/administrator. Many providers set up their SIPP as a master trust, with a bare trustee company as the main trustee, and register it with HM Revenue & Customs (HMRC). Each client who becomes a member of a SIPP has a separate account. This is their 'individual SIPP'. Where the member is to be a joint trustee of the account, they will establish a ring-fenced sub-trust under the SIPP's master trust.

Each member's individual SIPP is therefore subject to the provider/administrator's rules and requirements. The provider/administrator ensures that the SIPP operates in accordance with these, including the acquisition of assets in the name(s) of the trustee(s), which in some cases will include a member trustee. The SIPP provider, administrator or trustee will not normally provide regulated financial advice to the client so the additional services of a regulated financial adviser would be optimal.

The member makes all investment decisions in relation to their individual SIPP (taking advice as they see fit) but only in respect of investments that satisfy all of the SIPP provider/administrator's requirements.

Should the performance of the SIPP fall below acceptable standards, in terms of asset acceptance, increases in fees, reduction in service, or if their terms of proposition change, the member must accept these or make the decision to move away from that SIPP provider's product. This can be a time consuming and costly exercise.

A small self administered scheme is created as a trust but has a different structure to a SIPP as set out below:

A SSAS is an occupational pension scheme and thus it is created not by individuals or a provider but by an employer for its employees. SSASs can be multimember schemes for up to 11 members. HMRC registration processes are now examining employment links closely to try to identify schemes that may have been established to facilitate scams.

Unlike SIPPs, where member trustees are not essential, SSASs operate optimally when all members are trustees and largely, can control their own affairs. An employer creates its own SSAS under trust and the SSAS administrator registers it with HMRC as a standalone scheme.

A SSAS does not have to have a practitioner or a professional trustee. However, this will almost invariably be the case (and is advisable) because they will normally provide some or all of the services a SSAS requires. One of the most important of these is that the person(s) making up the SSAS administrator is (are) 'fit and proper' for the role or that they employ an adviser who has sufficient working knowledge of the pensions tax legislation, in particular the duties and liabilities of the SSAS administrator. These duties include reporting to the scheme members and HMRC and settlement of penalties and tax charges on the scheme should any arise.

Selecting SIPP and SSAS providers.

When selecting providers of self-invested products, advisers will have different criteria on which they should base their selections.

For SIPPs, they should be examining the product proposition, the asset acceptance process and conditions, the service and fee structure and importantly the long-term nature of the provider. In respect of the latter, financial stability, strength of capital adequacy and commitment to the market will be essential if the relationship is to be long term.

With SSASs, whilst the longevity of a relationship should always be key and many of the criteria above will also be relevant, other important points are the service and options that the practitioner can and will provide and how well they can be tailored to the client, and the services provided by the adviser. Essentially, the practitioner provides services to the trust rather than being a party to the trust.

SIPP and SSAS FAQs.

Our SIPP and SSAS frequently asked questions (FAQs) section will provide you with more information about SIPPs and SSASs, to help you decide whether this is the most suitable retirement vehicle for you.